Composite benefit rates are developed in order to cover the costs of fringe benefits offered by the university.

The rate is determined by creating a pool of benefit costs and dividing by the salary base per the requirements in OMB Circular A-21. The federal rates are negotiated with the government in advance for a fiscal year and any over- or under-recovery is included as an adjustment in a subsequent rate proposal.

FY 15-16 Changes

The Federal Government has determined that the use of the salary assessment caps that were in place can no longer be used for the CBR. All salaries are assessed the CBR and not limited to the previous assessment caps.

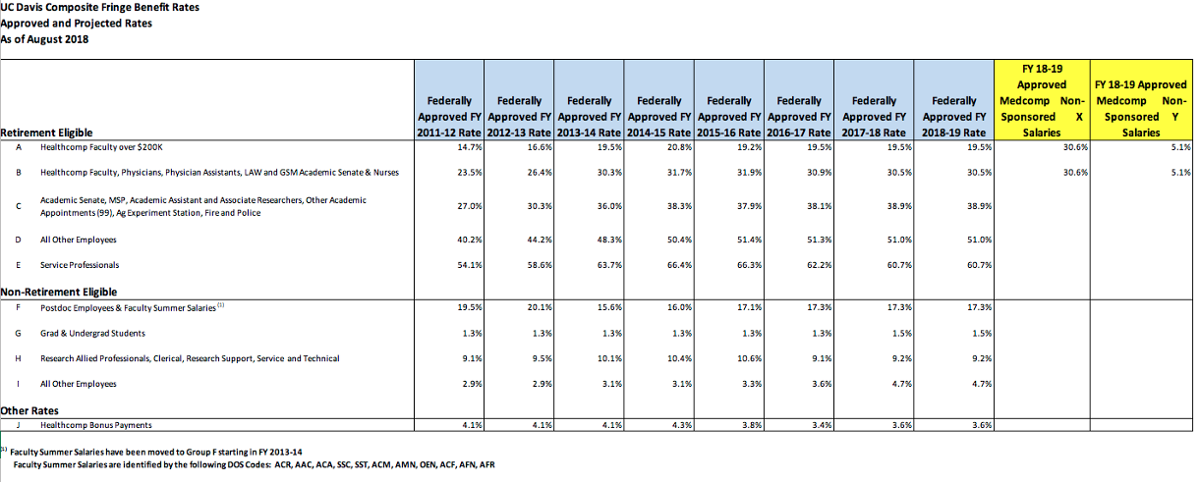

*Please click on the image to enlarge.

Costs in the Composite Benefit Rates include:

- UCRS (employer matching portion)

- Medical (employer contribution portion)

- Dental (employer contribution)

- Vision (employer contribution)

- OASDI (employer matching portion)

- Medicare (employer matching portion)

- OPEB (Other Post Employee Benefits)

- Unemployment Insurance

- Workers’ Comp Insurance

- Employee Support Program

- UC Paid Disability

- UC Paid Life

- Severance

- Employee Tuition Remission