What are F&A Costs?

When a researcher prepares a grant proposal, they include all the direct costs of conducting the research, such as graduate student researcher support, supplies, and staff time specifically dedicated to the grant. There are also costs of conducting research that cannot be attributed to specific research projects, but indirectly support research on an institutional basis.

Department administration, Sponsored Projects Administration (SPO), extramural accounting, library, facilities debt service, and the operation and maintenance of those facilities are all considered indirect costs. These costs are defined by the Federal Office of Management and Budget (OMB) as facilities and administration or “F&A” costs. Institutions recover these costs by applying specific percentage rate to a portion of the direct costs incurred on the grant. The percentage rates are negotiated for each institution with the Department of Health and Human Services by our Costing Policy & Analysis team. The current On Campus Research rate for projects awarded in 2024-25 is 61%.

Commonly referred to as Indirect Costs (IDC), when IDC is recovered by the institution, we have historically referred to the funds as Indirect Cost Recovery (ICR). Given these funds are reimbursements for real expenses to the University related to the institutional F&A costs, we now refer to the funds received as F&A Cost Recovery Funds.

- Additional detail and information on F&A rates and related policy information can be found on the Costing Policy & Analysis page.

- Resources are available through the Office of Research Sponsored Programs to understand how F&A Rates impact research proposals, grants, and contracts.

Budget Model Overview

F&A cost recovery funds collected from research sponsors each year are held centrally and distributed the following year, typically within the first three months of the year. The gross F&A generated is initially reported according to the Unit that generated it based upon contracts and grants expenditures that are administered within the unit per our financial system organizational hierarchy. This does not necessarily reflect the full amount of research funding or activity by faculty with appointments in the unit. Faculty may participate in research administered through an Organized Research Unit or other campus unit and that activity would be reflected in the Unit where the research was administered.

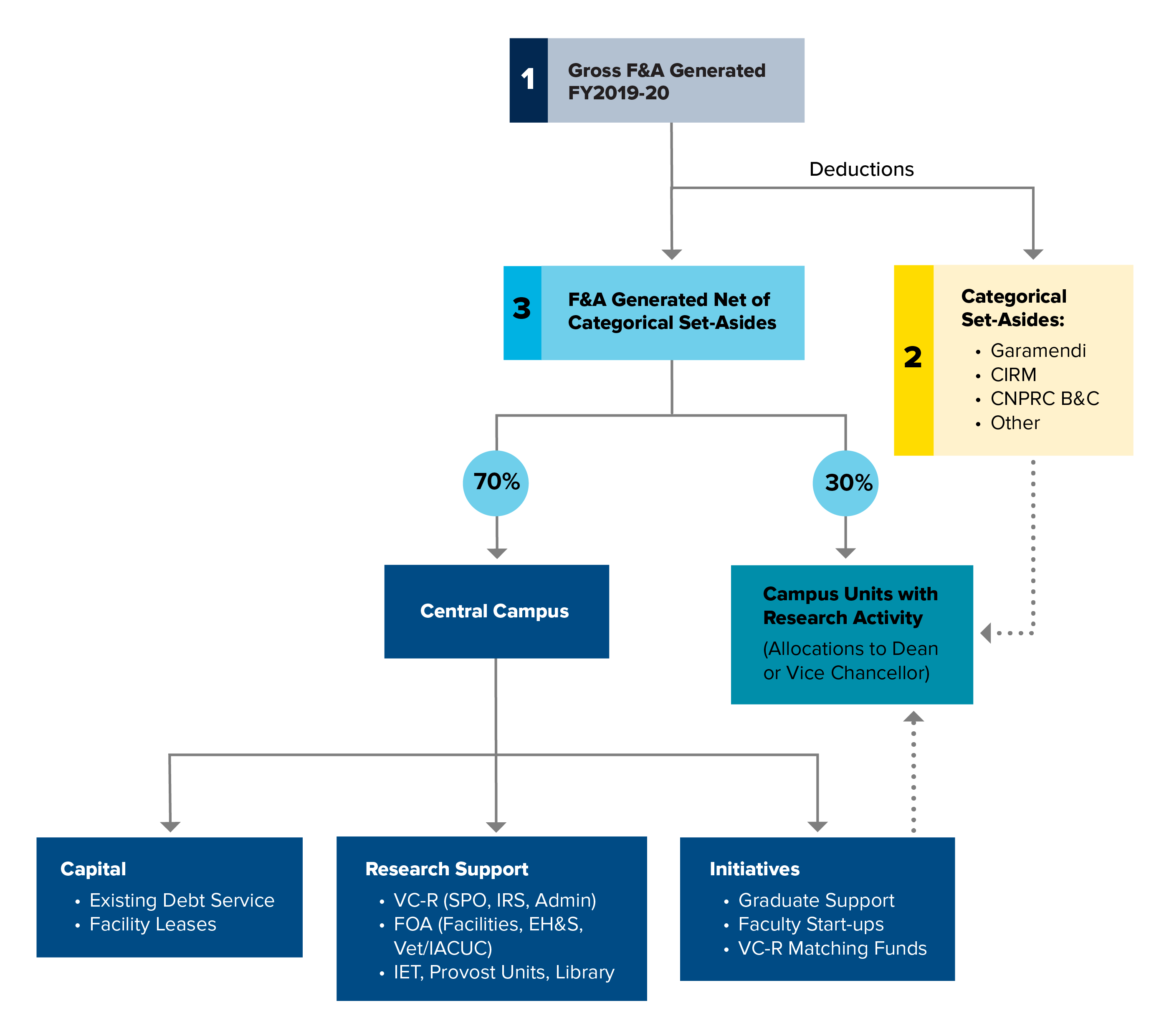

Prior to distribution under the standard budget model, several categorical set-asides are taken off the top for specific purposes. Of the remaining pool available for distribution, the generating Unit will retain 30% and 70% is held centrally.

Funds distributed to the units go to the Dean/Vice Chancellor, who is then responsible for determining how they will be invested across the departments within their unit. The F&A Budget model does not dictate how the Dean/Vice Chancellor should allocate funds to departments or PIs, those decisions are made locally.

Funds retained centrally support campus wide investments in research support and infrastructure. Because F&A funds are recovering costs for previous years investments, leadership must strategically invest the funds to support current expenditures and forward-looking needs for the university. Investments are made to meet a variety of needs such as:

- Debt service & leases for facilities included in the F&A cost pools

- Research Capital Projects

- Sponsored Programs Office and Contracts and Grants Accounting

- Research Matching Funds, Bridge Funds, and Research Support funds provided to researchers through the Office of Research and Senate Committee on Research

- Research Centers & Facilities Support

- Faculty Start-up Block Grants provided to Deans from central campus

- Extramural Buydown for Graduate Student Researchers

- Support for the Animal Care Program and Environmental Health and Safety

Budget Model Details

The Gross F&A Generated for the campus (see #1 in Figure 1 below) is captured from the financial system. The amounts generated by unit are based upon the financial department hierarchy according to the project owning financial department. F&A costs post to natural account 538000-Facilities and Administration Costs FA. Our financial system posts F&A costs to the ledgers on a regular basis, generally overnight, based upon the direct costs that the principal investigators attributed to the sponsored project and the appropriate F&A rate. The direct and F&A costs are submitted to sponsors for reimbursement by extramural accounting. The F&A portion is held centrally until ready to be distributed through the budget model.

From the gross pool of F&A that was generated, several categorical set-asides (see #2 in Figure 1 below) are removed and handled under a separate allocation methodology. These include F&A associated with projects in Garamendi financed buildings, projects sponsored by the California Institute for Regenerative Medicine (CIRM), F&A associated with UCD’s California National Primate Research Center (CNPRC), and a few other unit legacy allocation agreements.

The F&A Generated Net of Categorical Set-Asides (see #3 in Figure 1 below) is the remainder, which is split between the central campus and campus units with research activity. The model allocates 30% to Deans and Vice Chancellors and 70% is held by central campus to invest in campuswide research infrastructure and support as discussed above.

Figure 1. F&A Cost Recovery Methodology

Current Allocations

Recent Budget Model Allocations

Current Year

- Final 2025-26 F&A Cost Recovery Allocations (PDF) - updated Nov'25

- Current department level details are posted to a restricted access BOX folder (BIA Document Sharing > Campuswide Materials > 2025-26 > F&A Budget Model). Please reach out to your Dean/VC office to obtain a copy of the report if you do not have access to the folder.

Prior Years

- Final 2024-25 F&A Cost Recovery Allocations (PDF)

- Final 2023-24 F&A Cost Recovery Allocations (PDF)

- Final 2022-23 F&A Cost Recovery Allocations (PDF)

- Final 2021-22 F&A Cost Recovery Allocations (PDF)

- Final 2020-21 F&A Cost Recovery Allocations (PDF)

- Final 2019-20 F&A Cost Recovery Allocations (PDF)

Categorical Set Asides

Categorical set-asides are projects or programs that have special treatment with respect to the distribution of their F&A funds and do not follow the standard 70/30 budget model.

- Garamendi – “Garamendi” terminology comes from state legislation that was authored by then-Senator Garamendi in 1990. The California law (Government Code 15820.21)provided a mechanism for institutions that invest in a new or renovated research facility to recover infrastructure costs to support the debt service, utilities, and maintenance costs of the facility via F&A funds. Prior to the funding streams initiative implemented by the UC Office of the President in 2010, this was a critical process to ensure UC Davis recovered the appropriate amount of funds from Office of the President to cover those key infrastructure costs for the former Center for Comparative Medicine facility and the Genome and Biomedical Science Facility (GBSF). This set-aside component of the UC Davis F&A model provided the units administering research in these facilities with 85% of the F&A generated. These funds were used to pay debt service, utilities and operations and maintenance costs. Any remaining F&A funds after these obligations were met was then provided to the unit for internal allocation and investment like other F&A. As of 2023-24, only the School of Medicine activities in the GBSF remains under this set-aside. Central campus now directly pays the infrastructure costs for the units that were previously under this set-aside from the 70 percent share of F&A retained.

- California Institute for Regenerative Medicine (CIRM) – Due to the historical relationship of the UC Office of the President and CIRM, these F&A funds are expected to directly cover costs incurred in implementing the CIRM grants. Therefore, UC Davis continues to allocate 100% of F&A generated back to the unit conducting the research.

- CNPRC B/C Specialized F&A Rates – UC Davis has a set of specialized rates negotiated with National Institute of Health (NIH) that are used for research performed at the California National Primate Research Center (CNPRC or the Primate Center). Each specialized rate has an A-rate + B-rate component or an A-rate + C-rate component. The A-Rate component (or core grant rate) is treated like all other F&A funds and flows through the budget model 70/30 split. The F&A associated with the B and C Rates is required to be treated as program income, 100% of which must be returned directly to the Primate Center regardless of the administrative unit for the grant account. Additional information in the references section below.

- “OTHER” Set-Asides – There are two other legacy set-asides that do not flow through the standard budget model allocation. Continuing and Professional Education (CPE) has a agreement with the campus to retain 100% of F&A generated because CPE is a self-supporting unit expected to pay all their operating expenses, including capital, utilities, and auxiliary campus overhead. Additionally, SOM has an agreement similar to Garamendi, where the research conducted in the Shriners and Oak Park facilities are allowed to retain 85% of the F&A generated to cover debt service, utilities and operations and maintenance paid directly by SOM.

Additional references and issue papers

- 11-12 Indirect Cost Allocation Provost Letter (PDF) — Feb 2012

- 11-12 Indirect Cost Funds Allocation Letter (PDF) — Mar 2012

- Indirect Cost Recovery Allocation, Version 2 – June 2012: White paper on ICR as it relates to the Incentive-Based Budget Model implementation in 2011-12 — Jun 2012

- ICR Executive Summary – revised: Synopsis of ICR as part of the Incentive-Based Budget Model.

- CNPRC Specialized Rates Overview